Tax 2025/25 Uk. In the budget it was announced that, rather than increase in line with inflation each year, several personal tax allowances are to be frozen. For the 2024/25 tax year, employment allowance is £5,000.

From april 6th 2024 tax bands witness a rise in the starting point for income tax payments. This has been calculated using the changes proposed in the chancellor’s 2024 autumn budget for the.

2024 2025 Tax Rates Uk Belle Timothea, With yearly changes in the uk tax brackets, understanding where your income falls in 2025’s tax bands could be the key to saving more.

UK Tax Allowances and Tax Rates for 2022/23 Tax Year and Future Years, Download our tax tables to see all the main tax rates thresholds and allowances for areas such as income tax,

The hidden tax rise in the Autumn Statement BBC News, This means you can make gains of up to £3,000 in the tax year before you.

Capital Gains Tax Allowance 2025 26 Gov Uk Vina Aloisia, Download our tax tables to see all the main tax rates thresholds and allowances for areas such as income tax,

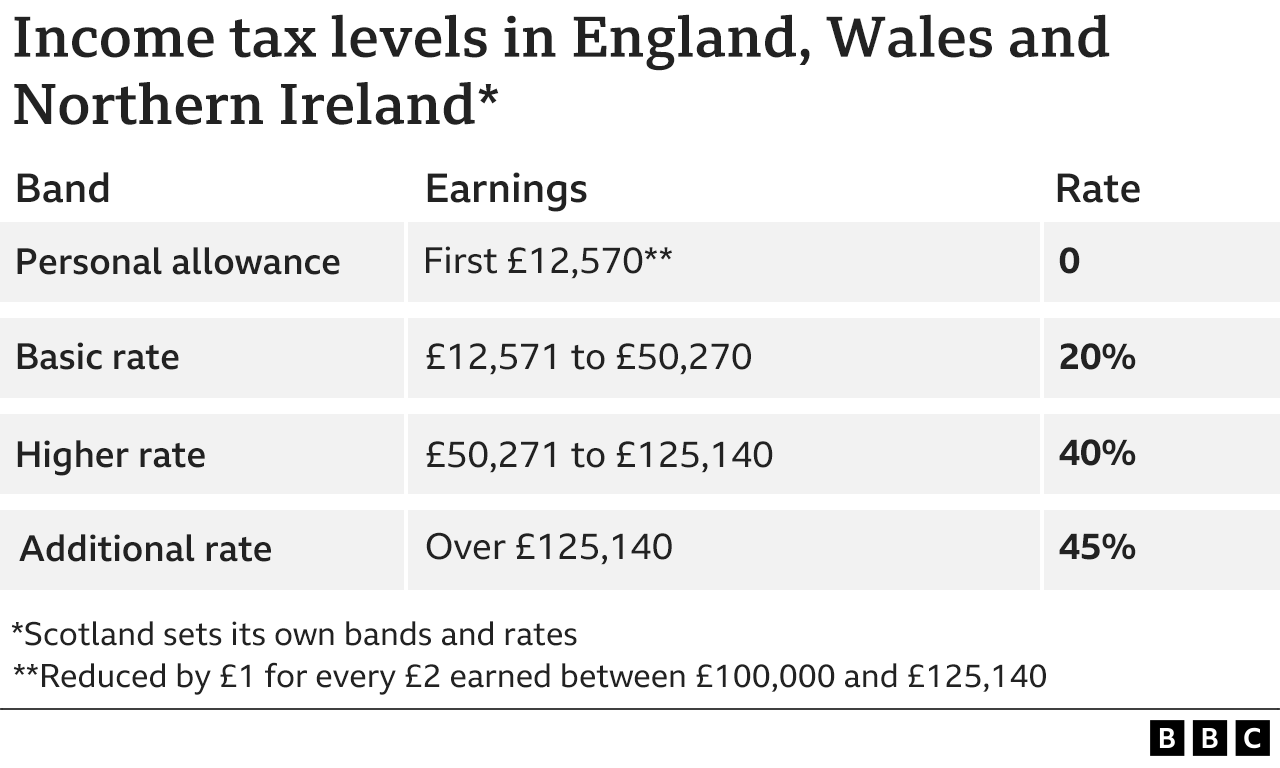

Tax Rates Over Time Chart, With a 2024 personal allowance of £12,570, you are not required to pay income tax on earnings up to this threshold.

List of Tax Codes UK and What They Mean Factorial, Wondering what the tax rates are for 2025/26?

Tax Bracket 2025 Uk Zenia Kylila, Download our tax tables to see all the main tax rates thresholds and allowances for areas such as income tax,

Tax Brackets 2025 Table Uk Debra Devonna, For the 2024/25 tax year, employment allowance is £5,000.